Do you want luxury travel perks to be a part of your traveling experience? A lot of people complain that getting started with miles and reward points is tricky. After all, where do you start?

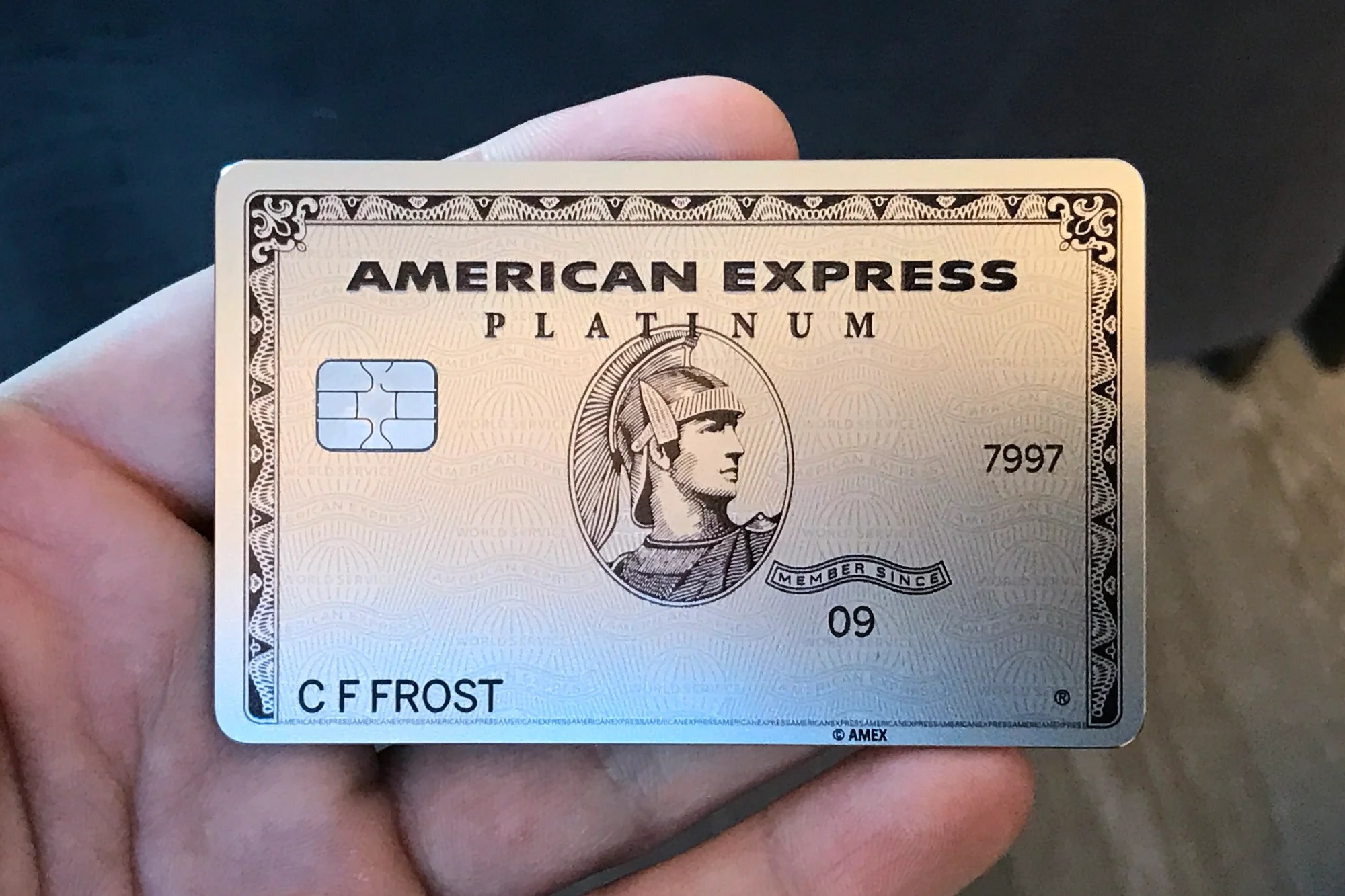

Well, it’s not that tricky with the American Express Platinum Card in place. Armed with the right knowledge and a good credit history, you could use the card to fly business class for free.

In this guide, you’ll learn the basics of AMEX Airline Credit and how you can get started using airline miles and points.

Features of AMEX Platinum Airline Credit Card

The AMEX Platinum Airline Credit offers a suite of benefits that is hard to ignore. You’ll receive $15 in Uber Cash for rides or eats orders every month with a bonus of $20 in December, which accounts for $200 annually.

You’ll also become an Uber VIP with the platinum card where every ride becomes a 5-star experience. If you love shopping at the Saks Fifth Avenue or saks.com, you can get up to $100 in statement credits annually for the purchases.

However, other than just rides and shopping, you receive up to $200 in airline credits every year after you have selected. You can use them on incidental fees, such as check-in baggage or for in-flight refreshments.

Other Benefits

You also get to Earn 5X Points on every Flight Booked Directly on amextravel.com. You also get access to over 1,200 airport lounges and get complimentary elite status with luxury hotel chains like Hilton and Marriott. But, that’s just not the end, there are more to come.

You can earn 5X Points on Prepaid Hotels that are booked from amextravel.com and about 1X Points on All the Other Eligible Purchases you make. These benefits are just the tip of the iceberg and as you deep dive in, you would understand the real value of having the AMEX Platinum card.

Eligibility Criteria

The eligibility criteria are mostly that the applicants must not have closed or opened an AMEX airline credit in the last 12 months. Also, the applicant must not have misused or defaulted as then, it would get difficult for the American Express to approve.

How to Apply

To get hold of this Amex card, head over to their website, and start filling out your details. You need to fill out your personal details and declared your income and address.

After which you submit the form and then get the decision in less than 30 seconds. You can also save and come back later to fill out.

Fees and Interest Rates

Here are the fees and interest rates of using the AMEX Platinum Credit Card

- Annual Membership Fee is $550

- There is no foreign transaction fee

- APR for Cash Advances is around 25.24% which is based on the market price

- The late payment and the returned payment can go up to $40

Contact Information

If you would like to get in contact with an American Express representative, you can reach them by calling 212-640-2000. We have also listed their mailing address below.

American Express

200 Vesey Street

New York, NY 10285-3106

The Bottom Line

Everyone can find different values from the Amex Platinum Credit card as it offers an array of benefits from airline credits to getting access to complimentary status on different hotels.

So, the more you can reap the advantage of it, the great the going would be. Go ahead and use it as much as you can yet earn from spending with the card are much more valuable.

Disclaimer: All credit products carry risk. Be aware of these risks by reading the associated terms and conditions.